We are seeing many Automated Export System (“AES”) violations as of late, especially with FedEx, DHL, and UPS shipments. As a result, please find information below regarding the export regulations and enforcement by U.S. Customs and Border Protection (“CBP”).

What is the Automated Export System?

CBP published the Trade Act regulations in the Federal Register on December 5, 2003. The rule requires advance transmission of electronic cargo information to CBP for both arriving and departing cargo. In the Federal Register notice, CBP identified the AES as the system for transmission of advance electronic export data for all modes of transportation.

On June 2, 2008, the U.S. Census Bureau published amendments to Title 15, Code of Federal Regulations, Part 30, Foreign Trade Regulations, mandating the filing of export information by the U.S. Principal Party in Interest (“USPPI”) or its authorized agent through the AES or AESDirect for all shipments where a Shipper’s Export Declaration (“SED”) was previously required. SED information filed to AES became known as Electronic Export Information (“EEI”).

When do you need to prepare the EEI formerly SED to be filed with CBP?

- Shipment of merchandise under the same Schedule B commodity number is valued at more than US$2,500 and is sent from the same exporter to the same recipient on the same day. (Note: Shipments to Canada from the U.S. are exempt from this requirement.)

- The shipment contains merchandise, regardless of value, that requires an export license or permit.

- The merchandise is subject to the International Traffic in Arms Regulations, regardless of value.

- The shipment, regardless of value, is being sent to Cuba, Iran, North Korea, Sudan or Syria.

- The shipment contains rough diamonds, regardless of value (HTS 7102.10, 7102.21 and 7102.31)

What happens if you fail to file the EEI or file the EEI late?

The absence or late filing of the Electronic Export Information in the Automated Export System (AES) or late filing of AES commodity data subjects the shipment to seizure.

If my goods get seized by U.S. Customs for an AES violation what do I do?

Read the following blog post for details about the U.S. Customs seizure process here and contact a professional experienced in such matters.

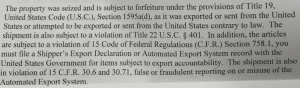

Additionally, look for the following language in your Notice of Seizure and Information to Claimants Non-CAFRA Form that would indicate an alleged AES violation:

Resource Information

For more information about this blog post, please contact Abady Law Firm, P.C. and speak with our customs lawyer at (800) 549-5099. Also visit www.customsesq.com to chat with a customs lawyer — who has insight into the Notice of Seizure — about your company’s export situation and to schedule a consultation. To chat with us, click the bottom right corner tab of our homepage.